Analytics, Technology, and Expertise for Investment Management

We combine financial markets expertise with data sciences, cloud computing, and statistics to create products and services for the investment management industry. We understand the dynamics of financial markets, the urgency of effectively managing risk, and the opportunities presented by a cohesive approach. Our clients include institutional investors, hedge funds and trading desks, banks and financial institutions, and private equity firms.

RADiENT Investment Analytics

Simplify fund selection and portfolio construction, to dramatically reduce the costs of managing a hedge fund portfolio.

RADiENT Investment Analytics Driven by Data Science™ utilizes artificial intelligence and machine learning, to automatically analyze information from hedge fund documents, regulatory filings, and market data.

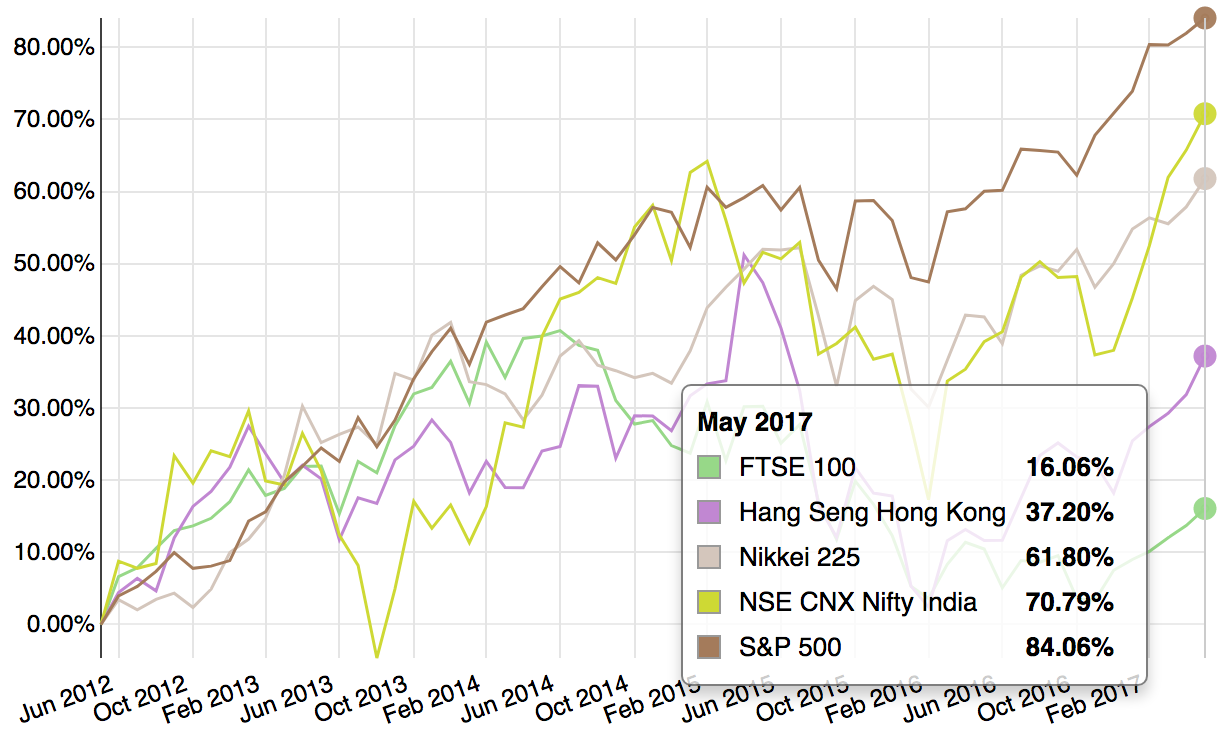

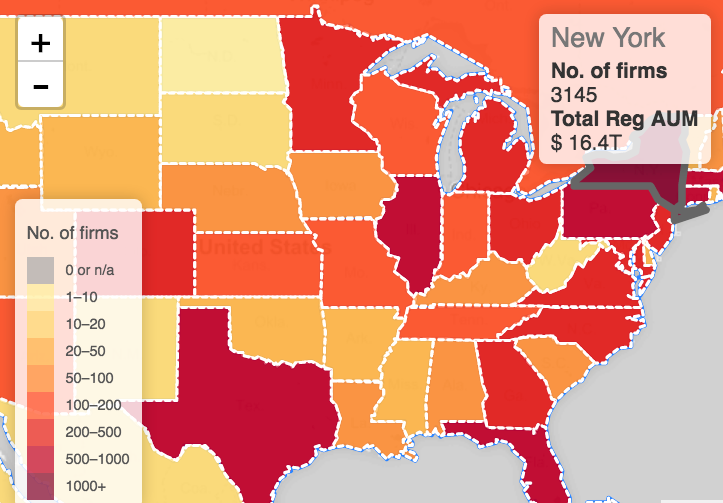

Analyze Regulatory Filings to Unearth Trends

Regulatory filings reveal a tremendous amount of information on investment managers, investment opportunities, and broad industry trends.

We use machine learning to automatically mine, structure, and visually analyze data from SEC regulatory filings, for research and due diligence.

Form ADV Investment Adviser Registration

Form 13F Investment Manager Portfolio Disclosure

Form 13D/G Ownership over 5% in a Public Company

Form 4 Material Change in Holdings of Insiders

Form D Securities Offering Registration Exemption

Analytics On-Demand for Private Equity

Enables Private Equity firms to rapidly analyze large volumes of information to validate an investment thesis, and make decisions supported by data.

Utilize data from internal systems, market research, news reports, and regulatory filings in both structured and unstructured forms to create revenue forecasts, model price sensitivity, and understand customer market segments.

Customized Solutions for Trading Desks and Hedge Funds

We assist trading desks at banks, financial institutions, and hedge funds to develop risk management frameworks, backtest quantitative systematic trading strategies, and develop related technology and data systems.